Bitcoin is a Swiss Army Knife

Kane McGukin | September 30 2021

For the first time in history, individuals have a monetary technology that isn’t just one thing, but is many. Bitcoin is a unit of account that offers more than just a spot price for transactions to happen. It is the 21st Century’s Swiss Army knife.

What makes Bitcoin and other cryptocurrencies complex or confusing for the average investor is that they are more than “just a currency” and they take more than just a few minutes to understand.

From time to time, I will update my thoughts and opinions on the topic of “what is money?”, as a means to stay up-to-date. In recent years, this is also a topic that is hotly debated, though it is not new and has changed many times throughout history.

VALUE IS WHAT INDIVIDUALS SEEK

We seek value in work, value in play, and value in things. Today, society is driven by the internet, causing individuals and businesses to increasingly operate off information and data. These digital inputs are now the crucial commodities for which economies around the world operate. The motto of “he who owns the gold makes the rules”, has shifted to “he who owns the data makes the rules”.

A digital native world requires a digital native money. A money that can do more than “just settle transactions”. Regardless of one’s stance, I believe it’s important to understand that Bitcoin is value at the base layer of a monetary network made for an internet native world. In this sense ‘money’ needs to be a technology, an asset, and a currency.

Bitcoin and Cryptocurrencies are:

- A Technology - a network and digital messaging protocols that communicate value.

- An Asset - an asset class that stores value when a savings mechanism doesn’t exist.

- A Currency - it’s supportive of standard financial transactions but with more features.

Value at the base layer is most important for any structure. The greatest value one can have is a strong foundation. Humans learned this over centuries of trial and error in the construction of homes, creation of lasting companies, and building of great empires.

Value at the base layer is most important for any structure. The greatest value one can have is a strong foundation. Humans learned this over centuries of trial and error in the construction of homes, creation of lasting companies, and building of great empires.

There is one common theme and that is a strong foundation. So why should money not hold to the same standards?

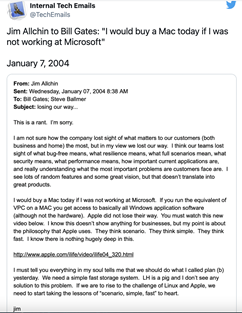

Without a reliable base everything tumbles… at some point; it’s just a matter of time. In the early years of our digital transformation, we found this out with personal computers.

In the 80’s and 90’s there were sound operating systems DOS (Microsoft) and Unix (Linux and Apple). These systems were extremely reliable and chosen for sturdiness though the evolution of Microsoft gave way to a flashier, easier, though more flawed system - Windows. Though faster, its weakness lay in an easily accessible foundation, its core, or… base layer

Bitcoin’s value, though slow and clunky, is its sturdy, secure, and reliable core which resembles that of DOS and Unix base operating systems.

When there is a reliable base layer, many unknown layers and promising future applications can be built on top to provide secure, sound communication and data transmission in easy previously unthought of ways.

This is the real value that can be found in strong foundations, strong base layers, and it is the value Bitcoin offers as a new monetary network and technology.

As new age builders build, we will come to better understand the value that can be delivered when our money transmits as a messaging protocol (technology) with the ability to connect and deliver data as money.

But in a manner that mankind has never seen before.

It’s scary to some but shouldn’t be because as Gail Sheehy said,

“if we don’t change, we don’t grow. If we don’t grow, we aren’t really living.”.

📨 NEWSLETTER ACCESS:

Get insights to help you thrive financially. Delivered to your inbox.

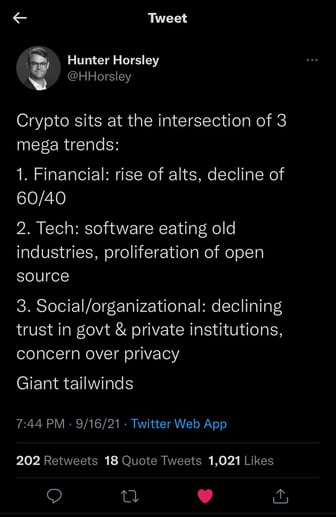

THE SWISS ARMY KNIFE OF MONEY

Bitcoin can be a payment rail or currency but doesn’t have to be.

It can be a savings mechanism, and asset class, or act as a store of value, but it doesn’t have to.

Bitcoin is a network that allows for multiple layers to be built on top to provide a better technology stack consisting of security, better connectivity, and communication flow.

The uniqueness of Bitcoin and Cryptocurrencies is that it can do all of the things money has traditionally been unable to do.

Thus, crypto acts as the Swiss Army knife of money.

Crypto and the Changing Financial Landscape

We are all aware of the immense value that can be derived from better communication channels. We’ve seen how Facebook connected old friends and distant families, how Dropbox provided faster ways to store and share files, how Google provided life changing digital tools to connect many aspects from our previously disjointed lives, and how Napster took the world by storm with peer-to-peer file sharing.

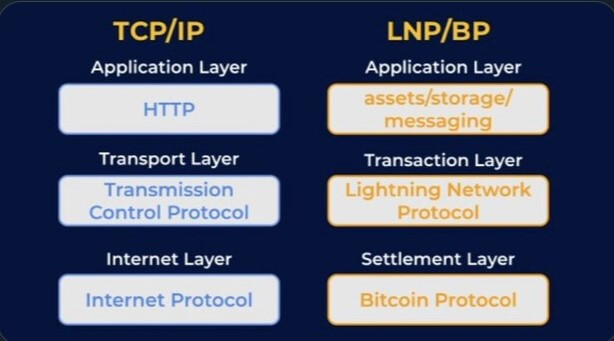

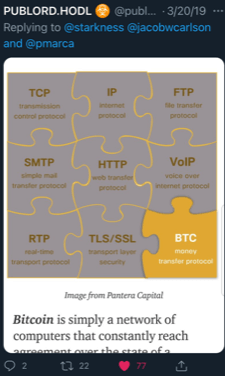

In the last 20 years, individuals and companies have used internet protocols to build applications atop the base layer (TCP/IP stack) of the internet.

used internet protocols to build applications atop the base layer (TCP/IP stack) of the internet.

Whether it be SMTP, HTTP, HTTPS, FTP, VOIP, P2P, etc, these technologies have transformed our entire livelihoods by simply changing our ability to connect, communicate, and interact. Bitcoin and other crypto-protocols combine many of these same features and will do the same for the ways in which we previously transmitted value. Or, more simply, how we use our money.

Many crypto use cases are just upgrades to the financial rails and aren't all that different from tech innovations we've seen happen in other industries. The crypto ecosystem is more or less bringing the value of APIs to our monetary system. One of the last three dinosaurs (banking, education, legal system) days are nearing an end.

Networks are powerful. So much so that nature operates entirely as one giant network. Ray Dalio touches on this briefly in his book Principles. Networks are powerful, self-healing, and adaptive. As we’ve entered further into the Digital Revolution creators are finding more and more ways to network together our daily interactions. Creating a true global economy where boundaries are less of an issue and the larger system is more supportive of globalization.

Networks like Bitcoin are zero to one. Peter Theil, in his brief but powerful book Zero to One, lays out why zero to one technologies are so powerful. Parker Lewis also discusses its role in Bitcoin Is Not Too Slow.

The greatest challenge for Zero to One technology is in their creation, going from nothing (0) to existence and use (1).

Once created, the amount of scale and transformative innovation Zero to One technologies deliver through sturdy foundations is life altering. All other iterations on top of the stack are one to n (1^n) uses of this new and powerful base layer of value. The transpiring innovations on the stack are what transform the way the world operates from that point forward.

BITCOIN IS AN EVOLUTION OF THE INTERNET, AND LIKE THE INTERNET IT IS ZERO TO ONE.

The internet (TCP/IP) was a value oriented base layer and in my opinion, it was the last truly transformative technology we’ve seen. All that we know and use today in our personal and business lives are layers of applications built on top of this foundation. EV technologies (electric vehicles/battery tech) will likely offer similar benefits in due time, but Bitcoin and cryptocurrencies are here in the now.

Bitcoin is the next evolution of the internet, adding a missing component of security. Sure, hashing, private keys, seed phrases, and self-custody are difficult today. But children of tomorrow will be well versed in these steps. They will do them with ease and likely as second nature. Remember, email, passwords, and two-factor authentication were difficult when they first arrived on the scene.

One point to keep in mind, as with all banking of years past, there has always been a key involved. So, we should not frown upon the fact that at this early stage the complexities of keys and storage are still being worked out.

Regardless of whether it’s in physical or digital form, a key has always been involved with banking. What’s new is that Bitcoin’s transformative layers, applications, and new financial rails will bring change to the way we transmit value throughout our lives… for the better... though it may seem chaotic or difficult in the near-term.

Bitcoin doesn’t know who you are. It’s an objective network of a consensus of principles, laws, and values that are not alterable by men or women’s subjective desires and opinions.

The freedom of price is the most important signal we can ask for. As when opinions of value change within an economy, then prices adapt quickly due to new data and more information. Without interference, price will always find a settling place.

Though volatility seems scary it actually allows for better clarity to see the necessary based on the information at hand.

Navigating The Noise

Our podcast that bridges the crypto and traditional finance gap

If there is not an ability to see an economy's undistorted price behavior, then over time there becomes an unreliable system for the economy to attempt to operate in. At some point, whether now or in the future, disruptions will arise in subjective and messaged systems as they are not protected from volatility and ultimately do not act in accordance with the data.

Given our societies are driven by data and information it’s important that we have an asset class that allows for investment in the opportunities that will arrive over time. We’ve seen this before with early oil lands and companies, or tech startups in the 90’s. Though usually the average investor doesn’t have the opportunity to invest in base layer technologies like Bitcoin, Ethereum, or others.

This is one of the more unique aspects of our investment landscape today. It’s more open and should be if the goal is to be more inclusive and accepting of ideas that may challenge traditional norms. If many of our systems and economies are adopting technologies that will drive the next wave of innovation, should our money and portfolio’s wait until the waters are clear? Should these opportunities not be available to everyone rather than just the accredited or venture capitalist? Should we not take the time to understand digital assets and where they might fit in our investment allocations, rather than toss them aside as funny internet nerd money?

Can a small portion of risk capital be allocated in a meaningful way to help drive growth in a manner that is somewhat protective given the volatility of digital assets? It’s still early, but as the traditional rails make way for new monies I believe the data will be supportive over both the long term and in hindsight.

This is why I believe Bitcoin is the 21 Centuries Swiss Army knife.

Disclaimer: Our intent in providing this material is purely for informational purposes, as of the date hereof, and may be subject to change without notice. This article does not intend to constitute accounting, legal, tax, or other professional advice. Visitors and readers should not act upon the content or information found here without first seeking appropriate advice from a trusted accountant, financial planner, lawyer or other professional.

Join us: