INVESTMENT MANAGEMENT

MOMENTUM

positive

MOMENTUM

The S&P cracked the 7,000 level in January for the first time in history, despite a negative contribution from the previously high-flying technology sector. With the rally in small- and mid-caps and continued strength international, we’re seeing broad-based support for an ongoing bull market. As such, our Momentum Dial remains in a Positive position.

ECONOMIC FUNDAMENTALS

negative

ECONOMIC FUNDAMENTALS

Consumer confidence fell in January to its lowest level since 2014, surpassing even the pandemic depths of 2020 as job market concerns continue to weigh on individuals’ perception of the economy. This pessimism is starting to impact big ticket spending, with the National Association of Realtors reporting record low pending home sales in January. We continue to keep our Fundamental Dial in a Negative position.

MARKET VALUATION

negative

MARKET VALUATION

Despite what has been a strong corporate earnings season so far, investors are heavily scrutinizing results to justify stretched valuations, most notably with Microsoft’s stock falling 10% despite beating revenue and earnings expectations given underperformance around AI-related aspects of the business. With stocks priced to perfection around lofty growth expectations, our Valuation Dial remains Negative.

On balance, our composite positioning remains somewhatdefensive, with one dial in a Positive position but two dials remainingNegative.

Do you lack clarity on the quality of your investments and their performance?

Are you looking to simplify and consolidate your assets with a trusted team of experienced professionals that sit on the same side of the table as you?

Regardless of where you are, or where you’ve been, we partner with our clients to help them manage their wealth and steward it across generations.

WE’RE HERE FOR YOU

The markets can be difficult to navigate and can be bumpy along the way. Through our collective 75+ years of experience, we’ve learned to keep it simple.

Our investment advice is based on a principled, evidence-based strategy that guides our decisions. We work to mitigate downside exposure while producing competitive returns over the long-term.

DISCIPLINED RISK MANAGEMENT

Our investment philosophy, known as the “Three Dials”, factors in three primary indicators: Momentum, Economic Fundamentals and Valuation.

The Three Dials provide a cohesive reading on the health, or “pulse” of the markets. The Dials provide a passive investment approach, with an active overlay. Each dial adjusts to data-driven indicators for maximized risk efficiency and an optimal allocation of diversified assets within your portfolio.

MONITORING AND REBALANCING

We conduct regular reviews to help ensure that your portfolio is aligned with your investment objectives and is appropriately positioned with the market environment.

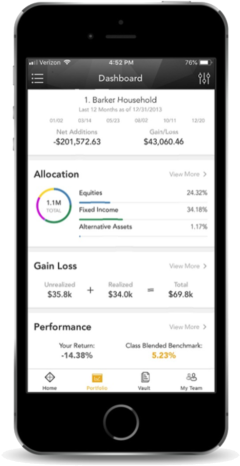

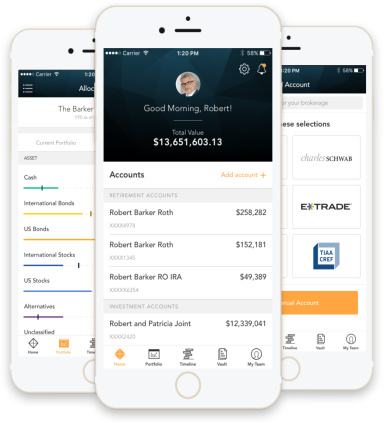

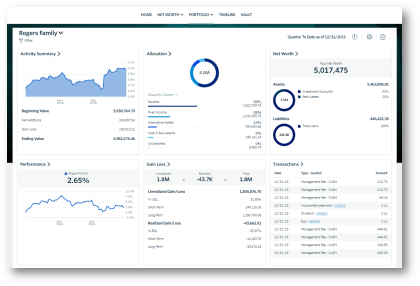

TRANSPARENCY AND ACCOUNT AGGREGATION

We offer a secure digital dashboard that serves as a home to all of your connected financial accounts, so you have a complete view of where you stand financially at any point in time.

MARKET AND ECONOMIC INSIGHTS

You will receive our market commentaries that provide clarity on the key issues that impact your investments.

© 2026 ARKOS GLOBAL ADVISORS | DISCLOSURES

WATCH VIDEO

WATCH VIDEO