Should I be investing in Cryptocurrency?

Kane McGukin | September 30 2021

By simply answering yes or no, we'd be doing you a disservice. Crypto is bigger than just “Should I own it”.

Crypto, like the internet, is going to change the way we live and how we do business. So, it’s more than just owning crypto. We truly believe you should do your best to understand crypto and how it will affect your life, your business, and your family over the next 10 years.

IT'S STILL EARLY

Internet adoption began in the late 1980’s but probably didn’t come into your life until the mid-1990’s at the earliest. Bitcoin was created over a decade ago (2009) but probably didn’t come into your life until the last year or two.

How Crypto Innovation Acts as an Asset Class

From an investment standpoint, the easy money has been made in Bitcoin and Ethereum; two of the most popular coins. Many more projects will start at $0 and go to the moon, as they say.

However, it’s not too late. There’s still plenty of time for digital assets to prove themselves. With a decade of annualized returns of 200%+ it’s really hard to look at cryptocurrencies and not say, “Can I continue to ignore this as part of my overall portfolio?”

We’ve reached the point where the genie isn’t going back in the bottle.

THE BIGGER RISK, MIGHT BE... NOT OWNING IT

Having a 0% allocation might be the greatest risk at this point. Zero, is the probably the wrong answer. It doesn’t have to be any harder than that. Buying crypto doesn’t mean you have to venture down the rabbit hole. Nor do you have to learn the intricacies of Bitcoin mining and the difference between Proof of Work and Proof of Stake.

But…

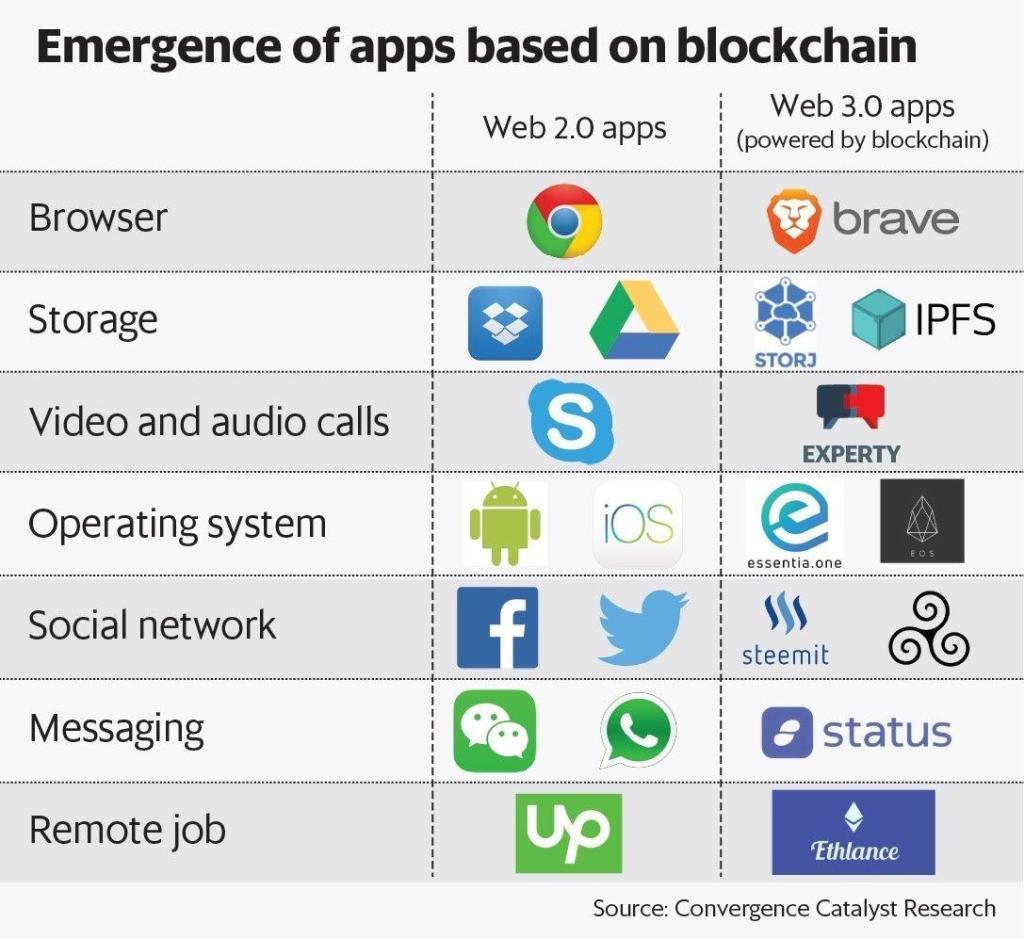

You should educate yourself and look to participate in the overall opportunity of the ecosystem. Crypto is the fourth iteration of the internet and it’s here to stay. It’s going to drive the next wave of innovation and growth.

This round of innovation consists of networks that are better designed for what we learned from the past with email, peer-to-peer sharing (Napster), social media (network effects), e-commerce, and the overall value behind data. We’re seeing an evolution of the backbone of the internet, TCP/IP, and the introduction of new protocols that connect, communicate, and operate in a near instantaneous manner.

📨 NEWSLETTER ACCESS:

Get insights to help you thrive financially. Delivered to your inbox.

TALE OF TWO COINS

Bitcoin offers stability and better security while Ethereum gives you innovation similar to API driven applications like Uber, Netflix, and Google. These base layer networks will drive value and growth like what we’re comfortable with from the S&P 500 (security) vs. Nasdaq (innovation).

Bitcoin is sound money. It’s a better global financial network and its adoption counters continued money printing by Central Banks since these actions have led to an increasingly destabilized financial system. Bitcoin fixes this.

Bitcoin is a financial technology that brings back reason, logic, scarcity, and a missing savings mechanism.

Ethereum is a breeding ground for financial innovation, much like the credit card network buildout of the 1950’s. It’s fast, furious, and seeks to change the world by integrating systems and data in such a way that efficiency increases, unnecessary middlemen are removed, and costs are reduced.

EDUCATION MATTERS WHEN CONSIDERING CRYPTOCURRENCIES

Individuals own it. Corporations own it. Countries now consider Bitcoin legal tender. So, yes… you should consider owning crypto.

How much? That depends on your risk tolerance, goals, balance sheet, and other aspects we can discuss. It’s all about what you are trying to achieve!

Ready to learn?

Join us for an introduction to Crypto

Disclaimer: Our intent in providing this material is purely for informational purposes, as of the date hereof, and may be subject to change without notice. This article does not intend to constitute accounting, legal, tax, or other professional advice. Visitors and readers should not act upon the content or information found here without first seeking appropriate advice from a trusted accountant, financial planner, lawyer or other professional.

Join us: