Generational Wealth Begins With Education And Financial Literacy

Outside of family, education is likely to have the largest impact on the outcome of an individual’s life. Education is crucial.

On average we spend around 17 years in the education system, when you reflect on that number it is a bit shocking that the most relevant subject in our lives is so sparsely covered. What’s that topic? It’s money, or financial education. Basic finance is a topic rarely covered in our school systems, yet money is the one thing we all need regardless of what path we choose in life.

Studies estimate that 78% of US citizens live paycheck to paycheck and roughly 4 in 10 adults are not able to cover emergency expenses of $400[1]. To reverse this trend, we need financial education.

“How do I prepare my kids for money?”

Clients and prospects commonly ask, "how do I prepare my kids for money?" If you step back and stick to the basics, it’s not a tough question but it does require time and energy. It’s a fairly simple process that requires focusing on only a handful of things that matter most when it comes to your financial choices.

To help fill the void, we’ve designed a “boot camp” for young adults in hopes to fill this gap. Our goal is to provide answers that are not typically covered outside of the household. As the saying goes, “more is caught, than is taught.” If you have kids, young or old, wouldn’t you like them to “catch” sound financial principles?

Do you think your life would have been easier if you’d learned how money worked at an earlier age? Would you like to give this gift to your children and the generations that follow?

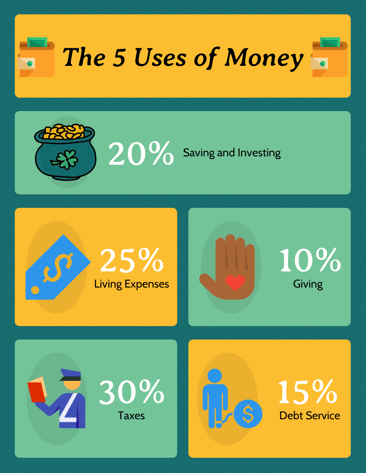

It can be much easier than it feels, and it starts with practicing the 5 basic financial principles.

- How to build a budget – Even large global companies operate off budgets.

- Compound Interest – This is applicable to both your decisions and your money.

- Diversification – Spread your investments into roughly 7 or 8 assets.

- Lifestyle Creep – FOMO usually leads to disappointment.

- The 5 Capitals – Change the path and pass down positive repeatable traits.

Why is financial education important?

Our children have the cards stacked against them. Through an onslaught of marketing and social media impressions, our children will be faced with decisions every day that could make or break them financially. It’s usually not one decision that makes or breaks a person, it’s a series of decisions over time where the results are compounding. If not equipped with sound financial principles, we can probably guess what types of decisions our children will make.

Before we leave them money, let’s equip them with wisdom and a prism to make sound financial decisions through. To answer a question we get from client's a lot, "how do I prepare my children for money?" We would say give them what society and schools are not giving them, financial wisdom!