Inflation, CPI, and The Rising Cost of Goods and services

Kane McGukin | September 30 2021

Too long; didn't read (TLDR) To beat inflation, you need to make different choices at home, diversify across different asset classes, and hold less cash than you might during non-inflationary times.

Regardless of how much we worry or fret, reassessing our choices and decisions is about all we can do.

"A nickel ain't worth a dime anymore” - Yogi Berra

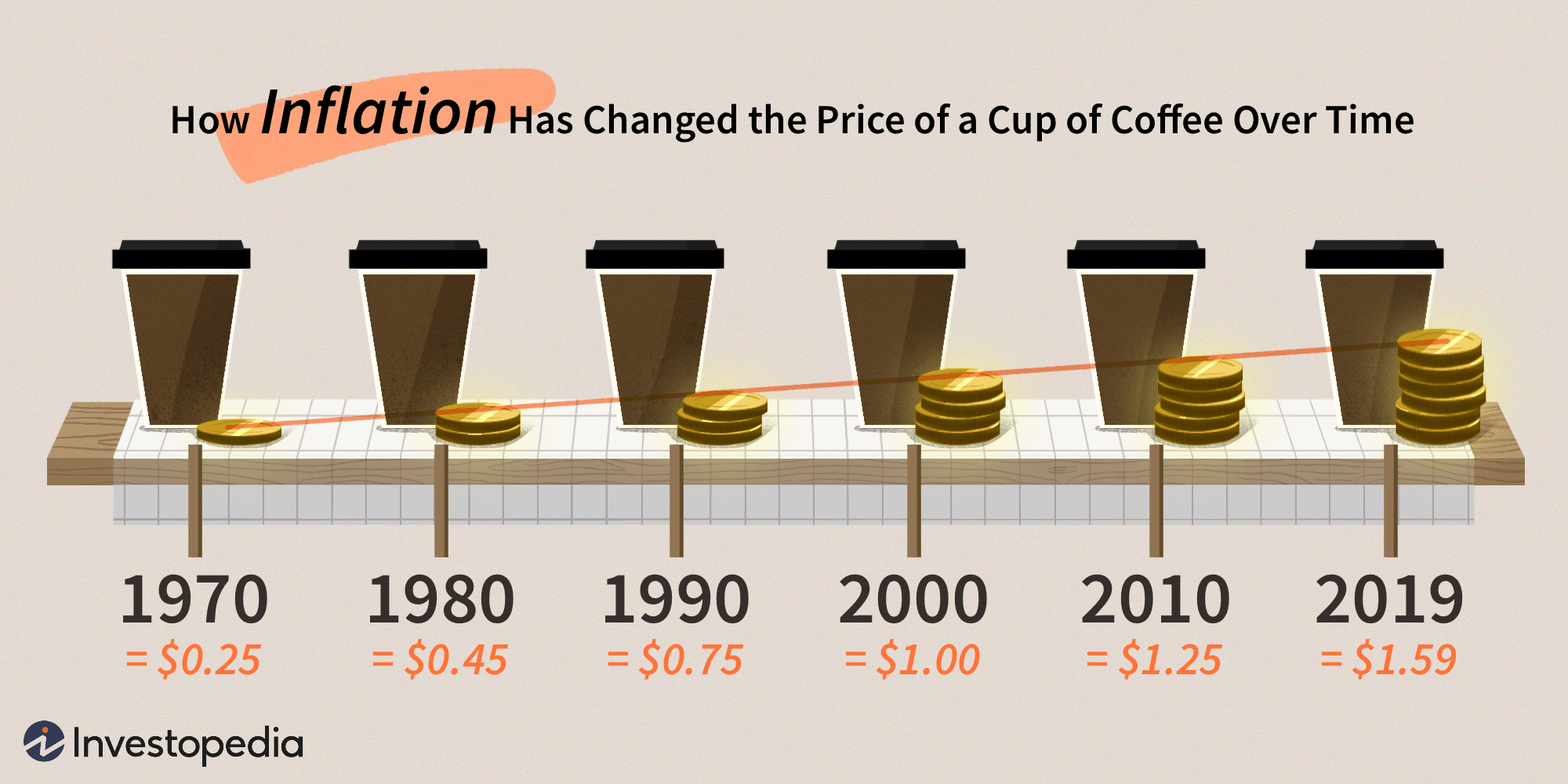

It is likely that you’ve recently heard friends talk about, heard the media talk about, or you’ve even talked about inflation. But, what is inflation? What does it mean for you, and why should you give it any attention at all?

If we look at Wikipedia, (for now) inflation is defined as:

"A general rise in the price level of an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy."

Who should you trust to determine if there is inflation?

We should trust our receipts. Regardless of what the Federal Reserve says, what mainstream media says, or what your neighbor says, inflation is simply a rise in prices. If your core costs are rising, there is inflation.

If you go to the gas station this week and prices are higher than last week, last month, last year then inflation is present. The same rule applies at the grocery store, for clothing items, houses, vacations, you name it.

For any item you purchase, if the same good costs more today than yesterday, then there is inflation.

What does inflation mean for you?

If your typical expenses are increasing at a faster rate than your income, you'll experience a decline in your standard of living. This happens because, without taking action, your purchasing power diminishes, making it harder to afford the things you once could.

An Overview of Historical Inflationary Periods

What Can You Do To Combat Inflation?

- For Starters, turn off mainstream media. You'll be happier and worry less!

- Focus on things that matter most within the four walls of your house. Look for ways to substitute goods and services.

- Finally, invest in assets and hold less cash.

In inflationary periods, there's an old market saying, "cash is trash". In these environments, if you aren’t spending or investing your cash, your it is technically depreciating faster and faster with each passing day.

A couple of ways to combat devaluation, during inflationary periods, is to buy more of what you know you will use in the future. You can also buy items that store value; investments like stocks, real estate, gold, cryptocurrencies, and other hard assets tend to do better during these periods.

You can also seek to buy or invest in things you know other people will need or will be willing to pay more for in the future. This approach invokes another market saying, "buy low and sell high".

What it does mean is you likely will have to make adjustments. You'll likely need to substitute what, when, where, and how you consume for the time being.

- Take a look at your monthly cash flow: Are there areas where you feel like you aren’t getting the value that you’re paying for?

- Can you redirect some of those funds to areas where you are getting more value?

Outside of investing and diversification, substitution is one of the main ways you can combat inflation.

Disclaimer: Our intent in providing this material is purely for informational purposes, as of the date hereof, and may be subject to change without notice. This article does not intend to constitute accounting, legal, tax, or other professional advice. Visitors and readers should not act upon the content or information found here without first seeking appropriate advice from a trusted accountant, financial planner, lawyer or other professional.

Join us: