Unlocking the Psychology of Bitcoin's Bear Market

Kane McGukin | September 21 2023

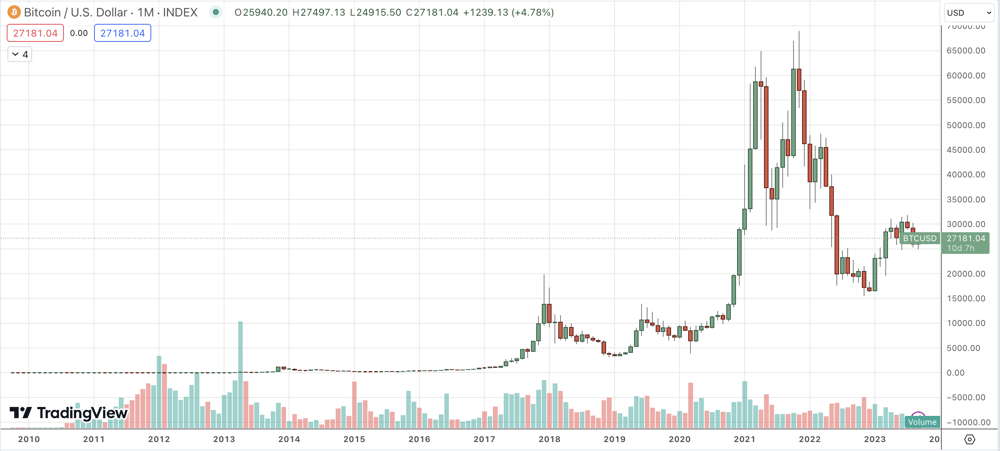

Bear markets in Bitcoin are brutal… and long. They’ve historically seen prices fall 70-80%+ and last about 1,000 days.

However, each time (3) the market tends to forget just how bad a Bitcoin bear market is. That’s where we are now.

You’re hearing calls that this is the worst bear market ever and it’s so much longer than before. It’s not. It’s inline and has similar characteristics to all of the past Bitcoin bears.

Bitcoin is in that part of the bear, the last third, where you see everyone’s hands go up. Everyone throwing in the towel, even the most gung ho Bitcoin influencers begin losing their steam and questioning their maximalist stance. It’s not openly said, but you can tell by the posts or lack thereof.

However, Bitcoin bears are when Bitcoin is built. So, there is a necessary beauty to this evil pain.

In general, I get the psychological nature of it. We all do. Because losing’s no fun. Just ask Deion Sanders. He’s a winner first and only likes to win. He’s open about it. Flamboyant about it.

“People say there’s no ‘I’ in team. Well, there’s not. But there’s an ‘I’ in win.”

“If you look good, you feel good, If you feel good, you play good, If you play good, they pay good.”

“Time is a wonderful storyteller.”

Time is a Wonderful Storyteller

This really fits!! Bitcoin halvings, the epochs, each have its own story and they require time to be told properly. Relatively speaking, a lot of time… Four years worth of time.

Each is slightly different, but yet is still the same as any other monetary story throughout history.

All money stories are filled with one key ingredient - man’s battle with the highs and lows tied to greed. Bitcoin’s story just so happens to be telling us how we’re transitioning money from the physical world to a digital one.

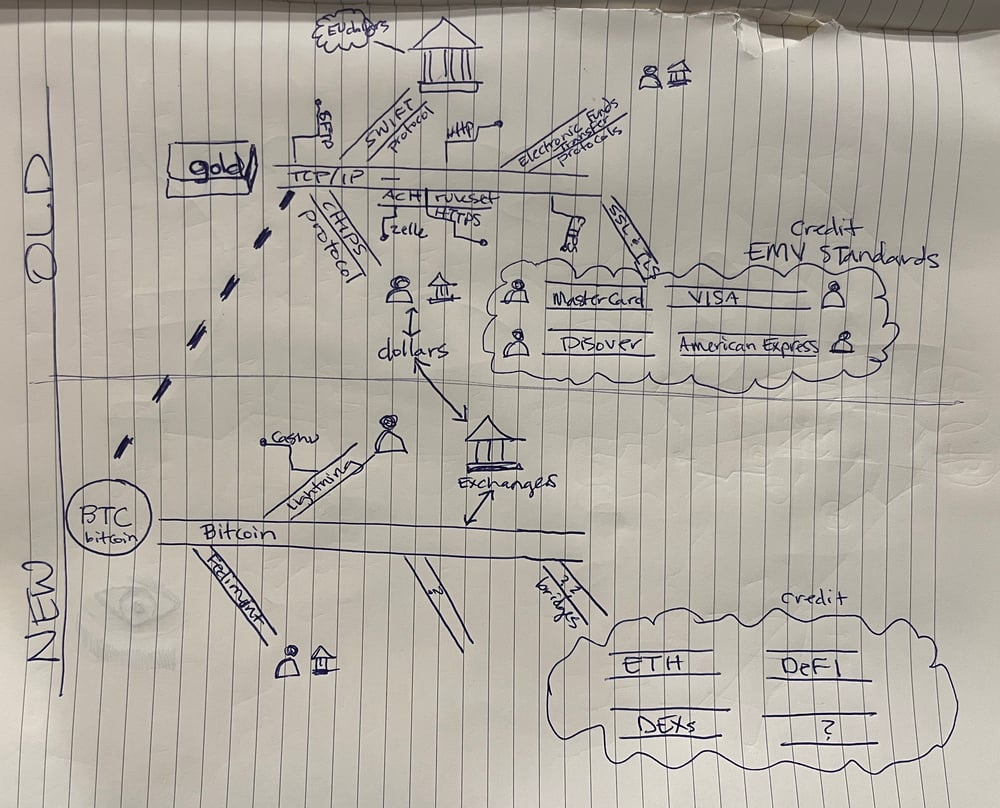

In the worst case, I believe it’s telling us how we’re building a parallel financial network that mimics the one we already know (image below). And at best, it’s telling us how we’ll fix broken money altogether.

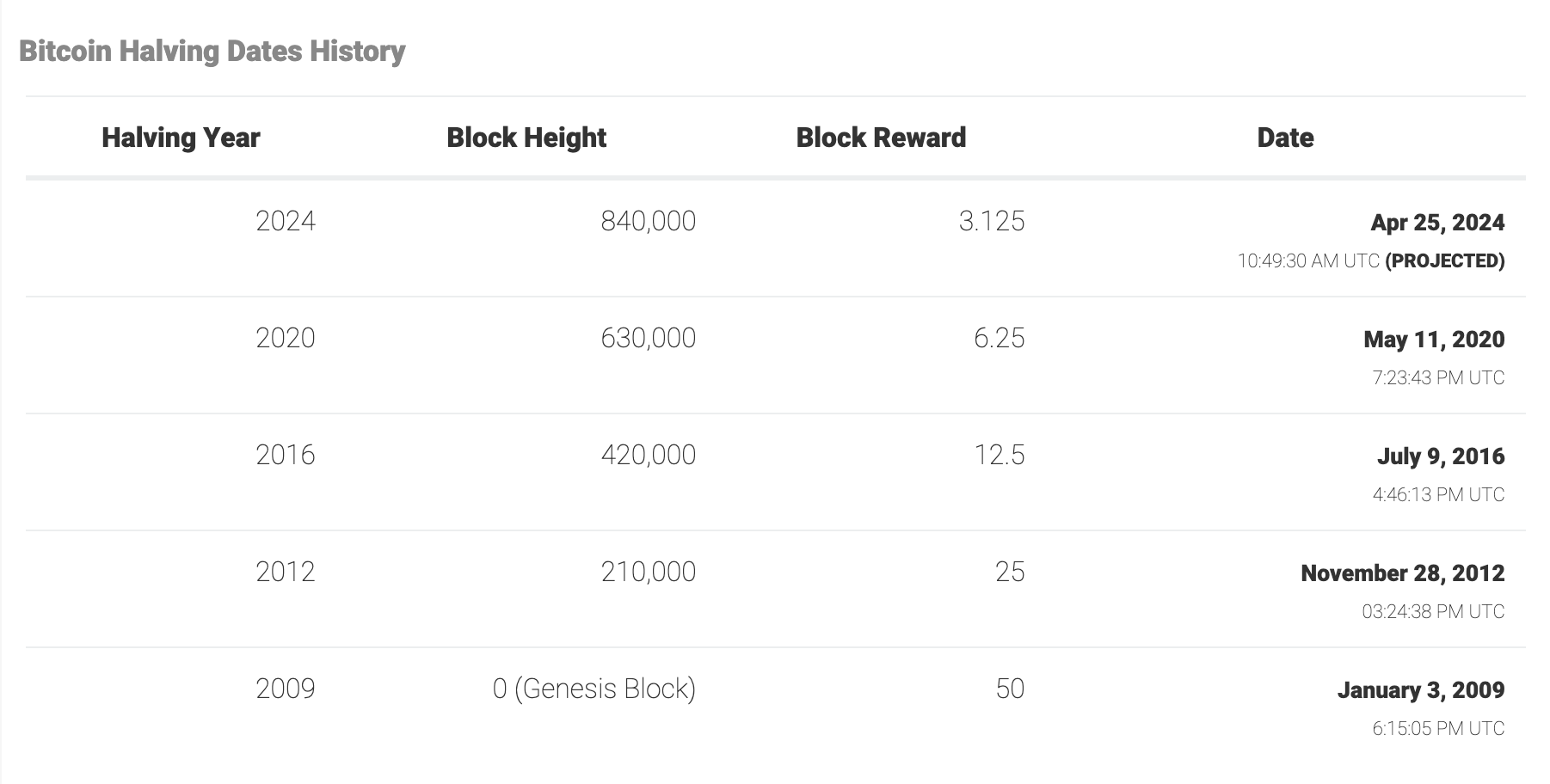

What’s a Bitcoin Halving? How Long Do They Last?

The block reward, the amount of bitcoin in each block, halves roughly every 210,000 blocks or every 4 years.

From this, we can make some assumptions related to how bear and bull markets work. Especially with 14 years and 3 halvings under our belt.

Navigating Bitcoin's Noise

A podcast that bridges the Bitcoin and traditional finance gap

Based on the data above and with a representative history of past Bitcoin bear and bull markets, we can make a fair number of assumptions and estimates about the life of a Bitcoin bear market.

Additionally, we can add traditional charting techniques to further verify, support, or deny these assumptions. It’s just another tool in the belt.

Putting it All Together

- A full halving: 4 years or 210,000 blocks

- bitcoin bulls (to high date): historically last 1/3 of a halving or an average of 73,832 blocks.

- bitcoin bears (to next breakout, not low): historically lasts 2/3’s of the time or an average of 136,168 blocks.

- On average, the bears have lasted roughly 979 days. That’s from the high day to the next breakout day. This is where the charts come into play.

📨 Bitcoin and Crypto 101:

Get insights to help you understand the new digital asset class.

- If past patterns hold true, then we can expect this bear to last another roughly 300 days (almost a year) taking us to July 2024 or so (discussed a little more in the podcast above).

- If this bear is like 2013 it last until around May 2024, just after the halving. If it’s like 2017, it could be September 2024.

However you split it, we don’t have to be 100% right. We just need to listen to what the markets are telling us, what the fundamentals are saying, and have a general understanding of how history has played out. That’s the goal.

Will market action repeat, who knows? Will Bitcoin moon to an all-time new high? I don’t know that either. But, I do have enough information to see that Bitcoin is here to stay.

The fundamental signs are there and growing. Like the Financial Accounting Standards Board’s recent announcement in favor of accounting rules that pave the way for companies to hold Bitcoin on the balance sheet.

Moves like this, along with a number of other fundamental cookie crumbs, don’t happen unless the table is being set for big boys, big banks, big funds, and big corporations to come to market.

Let’s see how the next bull plays out… When it finally gets here ;)

For more background and 101 on Bitcoin and Crypto check out our other resources.

*header image source: https://cointelegraph.com/news/10-000-bull-trap-why-bitcoin-price-is-now-likely-to-pull-back

Disclaimer: Our intent in providing this material is purely for informational purposes, as of the date hereof, and may be subject to change without notice. This article does not intend to constitute accounting, legal, tax, or other professional advice. Visitors and readers should not act upon the content or information found here without first seeking appropriate advice from a trusted accountant, financial planner, lawyer or other professional.

Join us: