A video replay of why Bitcoin and Cryptocurrencies are important and likely here to stay. Watch and learn what past technologies and evolutions of the internet can teach us about the Crypto revolution.

The Importance of Bitcoin and the Crypto Economy

Bitcoin's Defining Quarter: From Correction to Global Integration

Q1 wasn't just about price. It was one of the most consequential quarters in Bitcoin's history from a policy and infrastructure standpoint:

- March 6th: The U.S. announced the creation of a Strategic Bitcoin Reserve and a Digital Asset Stockpile.

- March 7th: The United States held a Digital Asset Summit at the White House. The meeting included prominent founders, investors and leaders with in the broader cryptocurrency ecosystem to lay the foundations for America’s approach towards bitcoin and the future of money.

From Volatility to Value: Key Takeaways from Bitcoin's 3Q Performance

In his book Zero to One, Peter Thiel describes "Zero to One" moments as groundbreaking shifts that create something entirely new, reshaping industries and societies. These innovations, like the automobile, the internet, and more recently, wealth creation in Bitcoin, enable exponential growth that compounds over time.

Recently, Charlie Bilello posted two charts that visually help explain the compounding power behind Zero to One investments. Relating these two notions allows us to better see Bitcoin as a long-term investment strategy.

BITCOIN INSIGHTS: THE CURRENT BULL MARKET, POLITICAL INFLUENCE, AND FUTURE TRENDS

With Bitcoin’s next bull well underway, we are watching a digital asset class enter young adulthood as institutions decide how they want to place it in portfolios.

At 15 years old, Bitcoin is now being adopted by the masses, including the who’s who of global financial institutions. Thus far, each cycle has been slightly different as new players are pulled in by the FOMO of prior peaks. However, there is one constant.

Bitcoin continues to grow and progress towards a much needed upgrade to our aging financial rails.

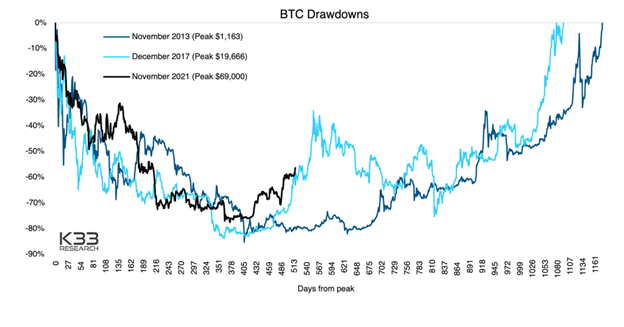

UNLOCKING THE PSYCHOLOGY OF BITCOIN'S BEAR MARKET

Bitcoin bear markets are severe and enduring, with prices plummeting by 70-80% and lasting around 1,000 days. Such downturns, while painful, are integral to Bitcoin's evolution.

These challenges form part of Bitcoin's larger narrative, illustrating the shift from physical to digital money in an attempt to improve financial networks.

Bitcoin + Banking Crisis

In 2023, traditional financial markets picked up right where the Crypto Crash left off. The past few years have seen a reintroduction of systemic risks. No market has gone unscathed, and each has spent its time on the front page.

Crypto Winter 2022

Year-to-date, a daisy-chain of leverage has unwound across the crypto ecosystem creating a liquidity crunch that sent fears throughout both crypto and traditional financial systems. This event was not too dissimilar from the banking crisis in 2008, leaving no coin unscathed, not even Bitcoin.

Learn More About Bitcoin and Crypto

Crypto, like the internet, is going to change the way we live and how we do business. So, it’s more than just owning crypto. We truly believe you should do your best to understand crypto and how it will affect your life, your business, and your family over the next 10 years.

Inflation, CPI, and the Rising Cost of Goods and Services

To beat inflation, you need to make different choices at home, diversify across different asset classes and hold less cash than you might during non-inflationary times. At the end of the day, regardless of how much you worry or fret, that’s about all you can do.

Bitcoin is a Swiss Army Knife

For the first time in history, individuals have a monetary technology that isn’t just one thing, but is many. Bitcoin is a unit of account that offers more than just a spot price for transactions to happen. It is the 21st Century’s Swiss Army knife.

What is DeFi?

For starters, DeFi, stands for Decentralized Finance. Basically, this means everything associated with a bank, plus innovation, minus the middlemen and many of the fees.

DeFi is applications, smart contracts, and code that runs on top of the Ethereum network.

© 2026 ARKOS GLOBAL ADVISORS | DISCLOSURES